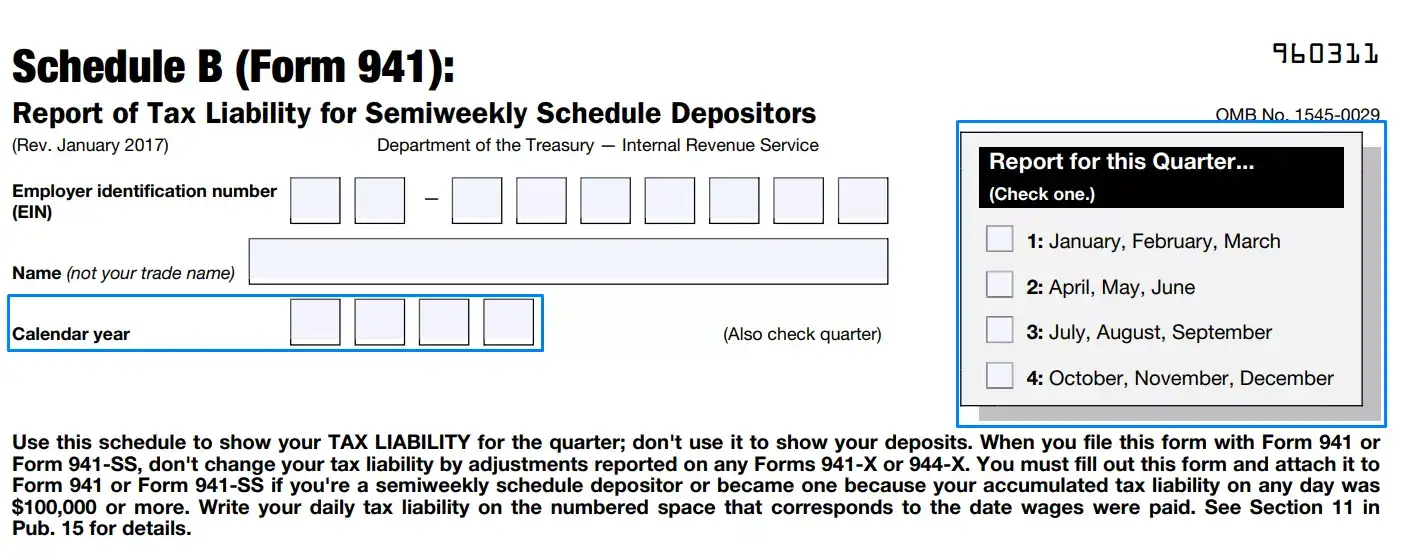

2024 941 Quarterly Forms Schedule B – You pay the federal employer taxes on a quarterly basis–March, June, September and December–and submit the payment with Internal Revenue Service Form 941. You can obtain a copy of the 941 Form . While owning a business can be rewarding on many levels, dealing with payroll taxes and their accompanying forms can be a pain. Depending on your employees and business type, you may need to work with .

2024 941 Quarterly Forms Schedule B

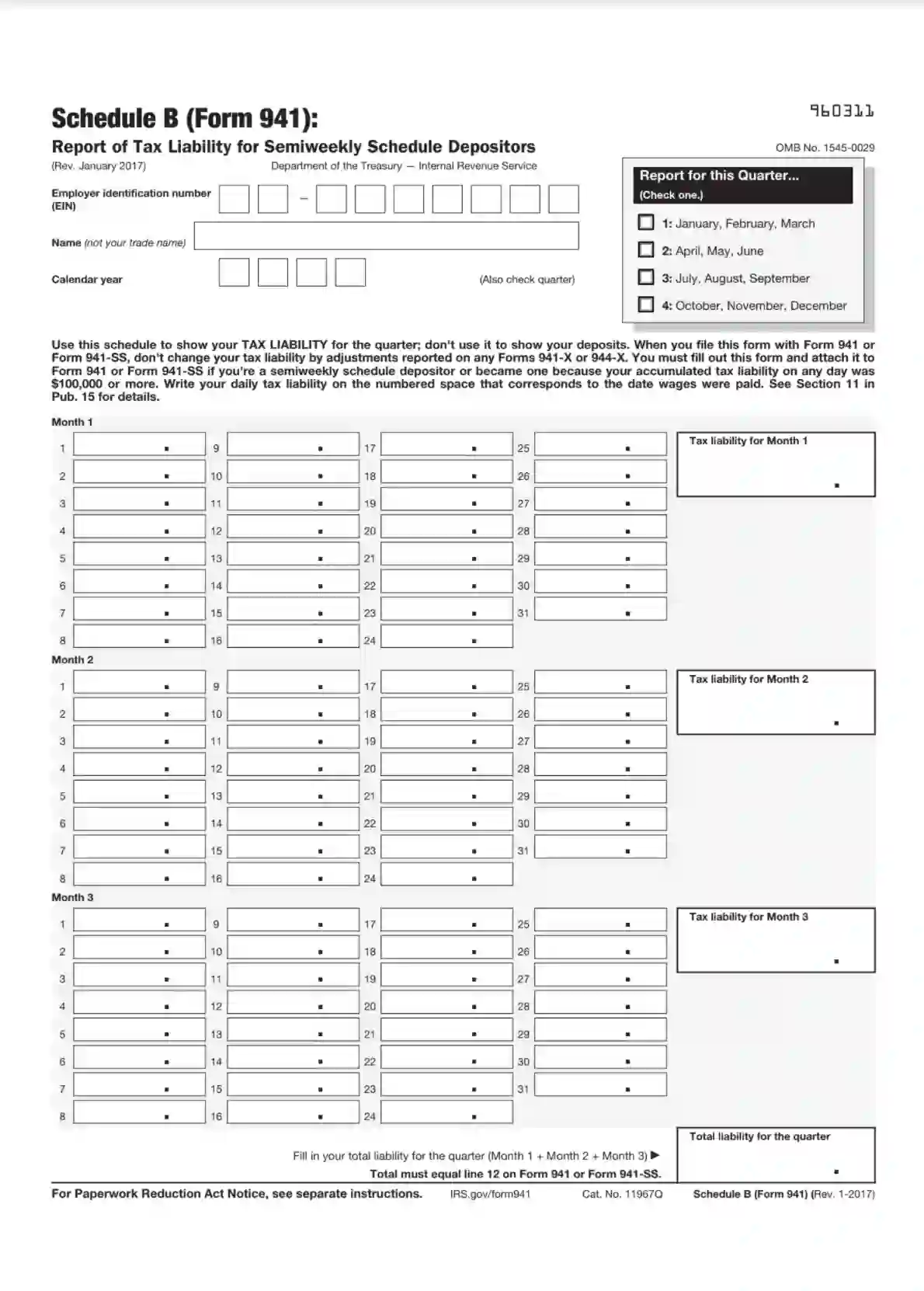

Source : form-941-schedule-b.pdffiller.comIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

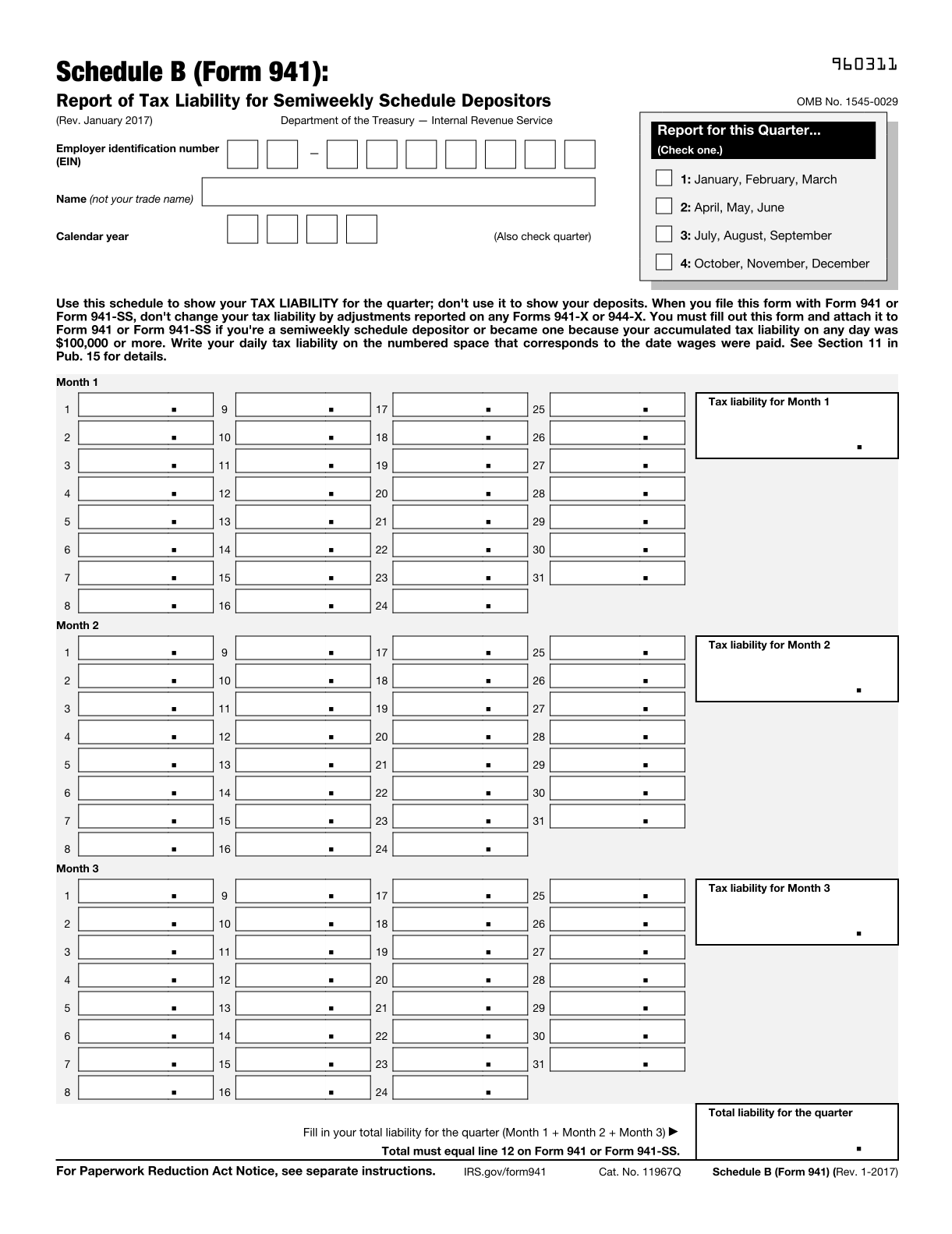

Source : formspal.comSchedule B (Form 941) (Report of Tax Liability for Semiweekly

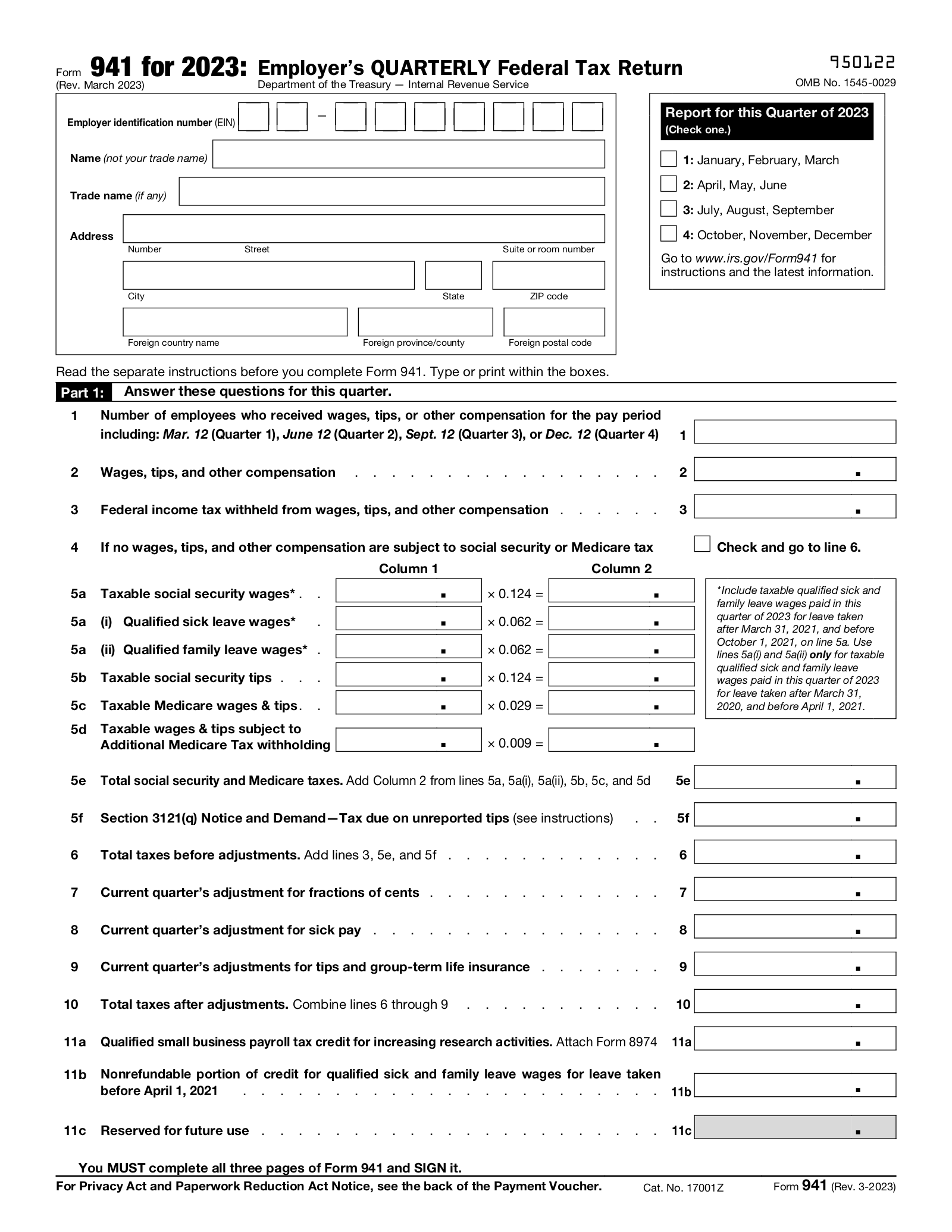

Source : hancock.inkForm 941: Employer’s Quarterly Federal Tax Return – eForms

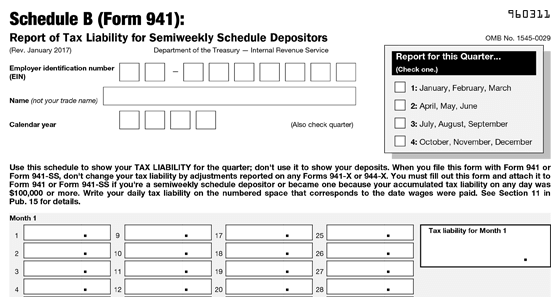

Source : eforms.comSemi Weekly Depositors and Filing Form 941 Schedule B | Blog

Source : blog.taxbandits.com2017 2024 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.comIRS Form 941 Schedule B for 2023 | 941 Schedule B Tax Form

Source : www.expressefile.comIRS Schedule B Form 941 ≡ Fill Out Printable PDF Forms Online

Source : formspal.com2017 2024 Form IRS 941 Schedule B Fill Online, Printable

Source : form-941-schedule-b.pdffiller.comIRS Form 941: Complete Guide & Filing Instructions | Paychex

Source : www.paychex.com2024 941 Quarterly Forms Schedule B 2017 2024 Form IRS 941 Schedule B Fill Online, Printable : Place your Employer Identification Number for the business into the box marked “b” on the form and your business name and address into the box marked “c.” If you don’t use a “doing business as . You pay capital gains taxes with your income tax return, typically using Schedule D. The data from Form 1099-B helps you fill out Schedule D and Form 8949 if needed. If you owned an asset .

]]>

More Stories

Last Summer On Earth Tour 2024 Calendar

Midwest Horse Fair 2024 Schedule

Creative Writing Internships Summer 2024 Fall